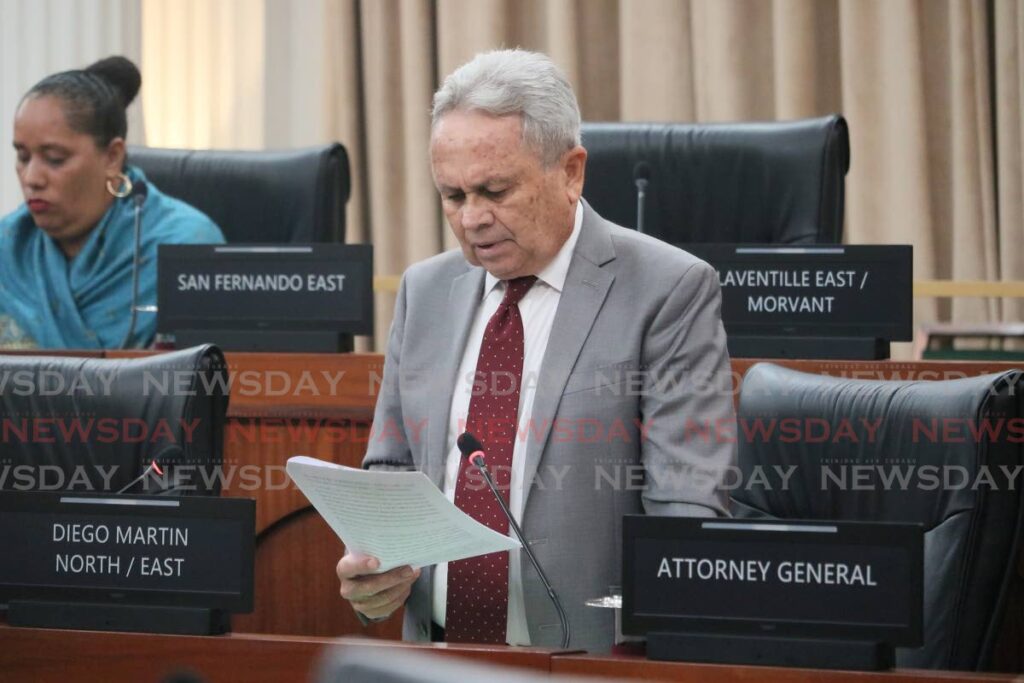

Finance Minister Colm Imbert reads a statement in Parliament on the Auditor General's Special Report on September 9. - Photo Courtesy Parliament

Finance Minister Colm Imbert reads a statement in Parliament on the Auditor General's Special Report on September 9. - Photo Courtesy Parliament Finance Minister Colm Imbert said the Special Report of the Auditor General on the Public Accounts for the Financial Year 2023 does not address the core issue of a $2.6 billion discrepancy in revenue and creates more unnecessary public confusion. He said premature commentary on the report, which was outlined in a newspaper on Sunday, was an attempt to gain public sympathy.

The special report was laid in Parliament on Monday. Speaking in Parliament, the Finance Minister said the purpose of the special report was to clear up statements by Auditor General Jaiwantie Ramdass that the Finance Minister sought to unethically backdate the 2023 accounts but did not do so.

“This special report does not assist in any way in clearing up the main issue of contention, which resulted from an overstatement of tax refunds and a subsequent under-reporting of net revenue leading to a $2.6 billion discrepancy in the revenue figures for 2023.

“Instead of confirming that the $2.6 billion discrepancy had been resolved and that there was, in fact, no missing money, the Auditor General has avoided making any definitive statement on that very important matter in this special report and instead has chosen to make caustic remarks about the staff and systems in the Ministry of Finance.”

Imbert also said there was premature disclosure of parts of the special report in a Sunday Express article titled Central Bank denied me access, which gave details of an affidavit dated September 5, 2024, filed by the Auditor General in the Constitutional matter against the AG over the payment of legal fees to Ramdass’s attorney, former UNC attorney general Anand Ramlogan.

Imbert said at the time the article was published, the special report had not yet been laid in Parliament.

“The premature disclosure of its contents is, in our view, a breach of process. It is clear to us that the premature publication of that emotionally charged affidavit in the Sunday Express was designed to evoke public sympathy.”

Imbert said the Auditor General claimed in the article that she was denied access to the electronic clearing system, negatively affecting her ability to perform a proper audit and check of the system and leading to the understatement of some $2.6 billion in revenue. He said he did not see the connection between the alleged denial of access and the confirmation that the $2.6 billion understatement had been resolved as stated by the Audit Team on July 22.

The Finance Minister said when he spoke to the Central Bank governor, he was informed that the Bank had not received official correspondence from the Auditor General about the matter.

“The Governor has informed me that following an email request made on June 24, 2024, by an official in the Auditor General’s Department, to examine the Bank’s Electronic Cheque Clearing System and its GoAnyWhere Platform, it requested official correspondence from the Auditor General with an outline of the scope of the potential engagement.

“The Central Bank also indicated that it was open and willing to meet with the Auditor General on the matter at any mutually convenient time.

“I am advised that to date, while it has received an outline of the scope of the proposed examination from a subordinate in the Auditor General’s Department, the Bank has not yet received any correspondence from the Auditor General delegating authority to her staff to act on her behalf on this matter, nor has it received a proposed time or date for the earlier requested meeting between the Auditor General and the Governor.

“As such, the Bank was unable to accommodate the request.”

Imbert said the Central Bank Governor remained open to meeting with and discussing any matter with the Auditor General.

“This meeting can form the basis for a precise and properly constituted engagement that while not in the nature of an audit of the accounts of the Central Bank (which has already been completed), could be very informative as regards public sector financial transactions and processes.

“It is hoped that the Auditor General will follow the established procedures and meet with the Central Bank governor on this matter or, alternatively, delegate authority in writing to the deputy Auditor General or another suitable staff member to act on her behalf.”

Imbert said he was also disturbed that while auditors in the Auditor General’s audit department were satisfied by the results of the report, Ramdass was not.

“At the exit meeting held on July 22, 2024, to complete the process of meetings on the Special Report, the audit team from the Auditor General’s department, which included some of the most senior auditors in that department, only expressed its satisfaction to the staff at the Ministry of Finance that the adjustment of $2.6 billion was appropriately accounted for.

“However, the Auditor General in her audit opinion on page 25, did not state that she was satisfied that the error in the public accounts for financial year 2023 was corrected.

“We view this omission on her part as a continuing campaign of non-co-operation and criticism of public officials in the Ministry of Finance by the Auditor General.”

The original, unamended version of the Public Accounts and the accompanying Auditor General's report were laid in the House of Representatives on May 25.

The dispute arose in April after the ministry sought to deliver amended public accounts to explain and rectify an error of $2.6 billion, which was attributed to Value Added Tax (VAT), Individual, Business Levy and Green Fund Levy contributions.

Ramdass initially refused receipt, as she claimed she needed legal advice on whether she could accept them after the statutory deadline for submission. She eventually accepted the records and dispatched audit staff to verify them, following instructions from the Attorney General.

Ramdass then submitted her original annual report, which was based on the original records, to Parliament.

She claimed her audit team was unable to reconcile the amended records based on documents it audited and also contended the amended records appeared to be backdated to the original statutory deadline date in January.

The Finance Minister appointed a team to conduct an independent investigation will be needed into the ongoing dispute between the two state bodies. Ramdass asked the AG for legal advice but he said he was unable to give her legal advice and would pay for any reasonable legal advice. Ramdass engaged Freedom Law Chambers's lead counsel Anand Ramlogan. She asked the AG to pay all her legal fees for the ongoing matters, which he declined to do.

Ramdass challenged in court Finance Minister Colm Imbert’s recommendation to Cabinet to initiate the probe, select the investigation team, set its terms of reference and have it report directly to him was biased. She also complained that the team was mandated to make findings on her conduct and that Imbert was responsible for their remuneration. The matter was upheld in the Appeal Court and the Finance Minister and the Cabinet asked to take it to the Privy Court. They were granted conditional leave on June 28.

3 months ago

44

3 months ago

44

English (US) ·

English (US) ·